Under Graduate Courses

Post Graduate Courses

PROFESSIONAL Courses

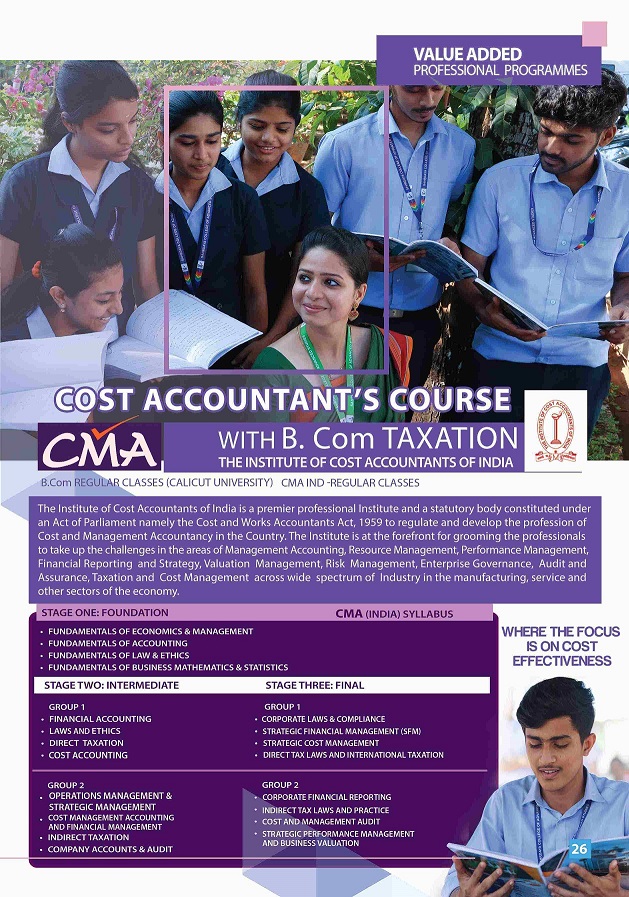

CMA (IND) – Cost and Management Accountant

CMA course provides you an in-depth knowledge to manage the business within the available resources. A cost accountant has to collect and analyze the financial information from all the areas of a company. The cost accountant often helps senior management to make key decisions, in some cases including decisions related to employees’ salaries and product pricing.

CMA course provides you an in-depth knowledge to manage the business within the available resources. A cost accountant has to collect and analyze the financial information from all the areas of a company. The cost accountant often helps senior management to make key decisions, in some cases including decisions related to employees’ salaries and product pricing.

A Cost Accountant

- Ensures services and processes are in compliance with account practices and regulatory requirements.

- Record and report the costs of manufacturing goods and providing services.

- Analyzes monthly and quarterly ledger activities.

- Prepares financial audit schedules and reports for management.

Eligibility criteria for CMA Foundation

- Passed Senior Secondary Examination under 10+2 scheme of a recognized Board or an Examination recognized by the Central Government as equivalent thereto or has passed National Diploma in Commerce Examination held by the All India Council for Technical Education or any State Board of Technical Education under the authority of the said All India Council, or the Diploma in Rural Service Examination conducted by the National Council of Higher Education.

Eligibility criteria for CMA Intermediate

- A candidate should have passed Senior Secondary School Examination (10+2)and Foundation Course of the Institute of Cost Accountants of India.

- Graduation in any discipline other than Fine Arts.

- Foundation (Entry Level) Part I Examination of CAT of the Institute.

- Foundation (Entry Level) Part I Examination and Competency Level Part II Examination of CAT of the Institute.

- Passed Foundation of ICSI/Intermediate of ICAI by whatever name called along with 10+2