Under Graduate Courses

Post Graduate Courses

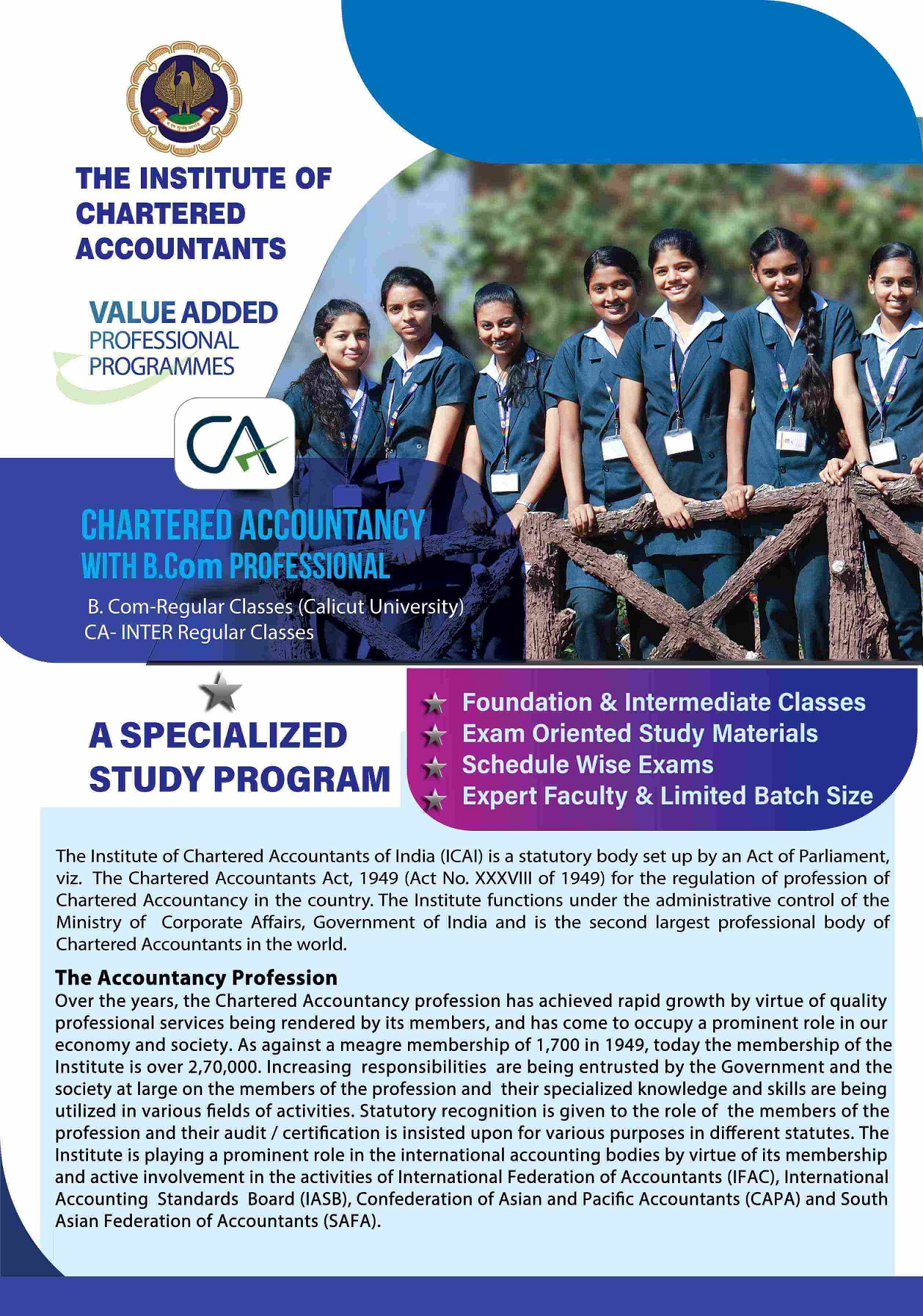

PROFESSIONAL Courses

CA – (Chartered Accountancy)

Chartered Accountant is a designation given to an accounting professional who has received certification from a statutory body that he/she is qualified to take care of the matters related to accounting and taxation of a business, like file tax returns, audit financial statements, and business practices, maintaining records of investments, preparing and reviewing financial reports and documents. A Chartered Accountant is also qualified to offer advisory services to clients which include companies and individuals.

Chartered Accountant is a designation given to an accounting professional who has received certification from a statutory body that he/she is qualified to take care of the matters related to accounting and taxation of a business, like file tax returns, audit financial statements, and business practices, maintaining records of investments, preparing and reviewing financial reports and documents. A Chartered Accountant is also qualified to offer advisory services to clients which include companies and individuals.

Certificate Issuing body

Becoming a certified Chartered Accountant requires completing three levels of training designed by the Institute of Chartered Accountants of India (ICAI). The ICAI is a statutory body that regulates and maintains the profession of chartered accountancy in India. Under the Scheme of Education and Training, a candidate can pursue Chartered Accountancy Course either through, Foundation Course Route or Direct Entry Route. In India, the Institute of Chartered Accountants of India (ICAI), conducts CA exams and certifies a candidate as a qualified Chartered Accountant on successful completion of the three-level course.

Examinations conducted are

- Common Proficiency Test (CPT)

- Intermediate (Integrated Professional Competence) Examination

- Final Examination

Eligibility

Foundation course is the entry point into the course after Class XII, while Direct Entry is for those who have completed Graduation